We’re buried so deep in the property management world that our idea of a wild party is optimizing integrations and reading up on the latest industry updates… So grab a cola (or whatever you like) and sit down to learn about the Social Security benefit increase that’s come as a result of the Cost of Living Adjustment.

The COLA is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers ( C.P.I.-W). An increase in Social Security occurs when the average inflation reading from July, August, and September of the current year is higher than the same period from a year earlier.

So, as of January 2024, over 71 million Americans will see a 3.2% increase in their Social Security benefits and supplemental security income payments. To take an example, this means that Social Security retirement benefits will increase by over $50 a month on average while a retired couple will see an increase of $94 a month.

At the same time, the earnings limit for workers who are younger than the "full" retirement age will increase to $22,320. This is 66 for those born from 1943 to 1954 and rises by two months per year until it hits 67 for those born in 1960 or later. Basically, the rule change means that more people can make more money without a chunk getting taken out of their benefits (yay for affordable housing residents!)

Overall, Social Security benefits impact survivors, those with disabilities, and spouses of disabled or retired workers, but they are particularly important for lower and middle-income retirees who don’t have 401(k)s and employer contributions. With this money, which is adjusted to inflation, they can maintain their buying power while property prices rise.

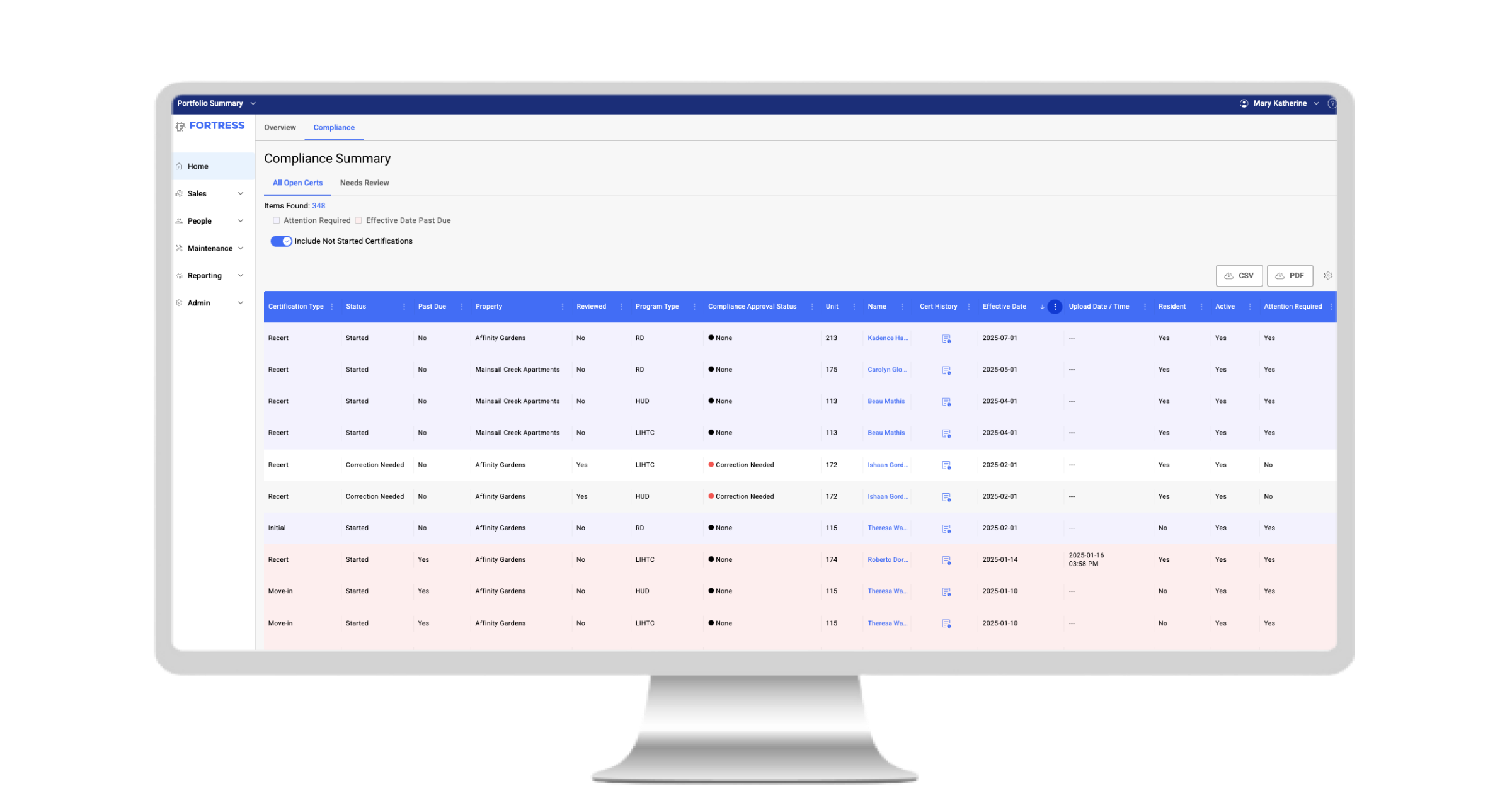

Current beneficiaries will find out their new benefits amounts in December 2023 but can get that information sooner by setting up an online account. Meanwhile, you can use FORTRESS to stay in touch with your residents and up to date on the latest affordable housing regulations. Get in touch to learn more.

.jpg)